April 2022 NIC increase: What does it mean in real terms?

7th October 2021

Following the government’s announcement to temporarily raise NICs and dividend tax rates by 1.25% in April 2022, we discuss what this means in real terms for the average small business owner.

What are NICs?

NICs (National Insurance Contributions) make up a tax that is paid by the self-employed, employees and their employers. Introduced in 1911, its original purpose was to provide a pot of money with which to provide financial relief to those who had lost their job or who needed medical treatment. These days the money is ring-fenced by the government to be used for funding within the NHS, benefits and the state pension.

Why is it being increased and who does the increase apply to?

It was a surprise move by the current Conservative government to raise NICs, as it went directly against their previous manifesto of not raising taxes. The reason given for the hike is to pay for the ongoing health & social care impact of the COVID-19 pandemic, supporting the NHS going forward and plugging the £12bn gap in future care provision. The government’s aim is that nobody should pay more than £86,000 for their care in their lifetime.

The increase in NICs has been firmly communicated as temporary, being replaced in April 2023 by a separate “Health & Social Care Levy”. Legislation is still to go through but it has already been said that the future levy will also apply to anyone employed or self-employed over state pension age – an age group currently exempt from paying NICs.

The current NIC increase has been applied across the board of businesses, employees and the self-employed. These are the key takeaways:

- Rates of National Insurance contributions are to increase by 1.25% in April 2022

- For workers, this will apply to both Class 1 (employee) and Class 4 (self-employed) contributions

- The increase will apply to all those (employees, self-employed and partners) earning above the class 1 primary threshold/class 4 lower profits limit (in 2021/2022 this is set at £9,568)

- Employers will also see an increase of 1.25% to Class 1 secondary (employer). They will pay this for any employee earning above the secondary threshold (currently £8,840 for the 2021/2022 tax year. Employment allowance (currently £4,000) will continue to apply, including other reliefs and allowances.

- The 1.25% increase also applies to Class 1A and 1B (taxable benefits of employment)

- There will also be a 1.25% increase in dividend tax rates, moving to 8.75% for basic rate taxpayers, 33.75% for higher rate taxpayers and 39.5% for additional rate taxpayers. The £2,000 dividend allowance will continue to apply.

What will this mean for businesses

Aside from the additional 1.25% added to the bottom line of employee costs, it is feared that the administration cost of two changes will bring further financial impact to local businesses. This comes at a time when companies have already faced economic hardship/additional costs through the pandemic, Brexit and moves such as MTD.

The decision for business will be whether to absorb these costs into profits or pass them on to customers or employees in the form of price increases or wage reductions respectively.

What will this mean for individuals?

The Treasury carried out an analysis of the impacts and found that those households in the highest 20% of incomes will contribute 40 times more than those in the lowest 20% bracket. However, there has been some criticism that younger and lesser-paid workers will end up worse off than others.

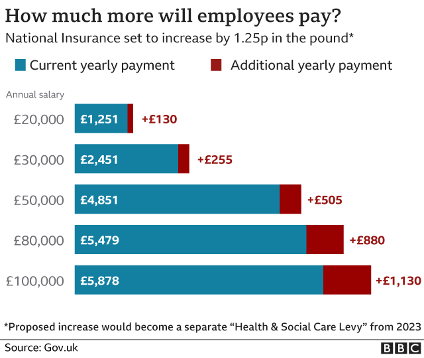

In this chart from the BBC, we can see that the increase at first appears relative to wages. Importantly however, National Insurance is only paid on earnings between £9,564 – £50, 268. Above this threshold NICs are set at just 2%, meaning those earning over £50,000 will proportionally pay less.

Example Impact of 1.25% Increase from 2022/2023: £40k income (£9,500 salary with balance in dividends)

| Current Rules: | ||

| Non-Savings Income | Dividend Income | |

| Salary | £9,500 | |

| Dividends | £30,500 | |

| Totals | £9,500 | £30,500 |

| Less: PA | -£9,500 | -£3,070 |

| Taxable | £0 | £27,430 |

| £2,000 @ 0% | £0.00 | |

| £25,430 @ 7.5% | £1,907.25 | |

| Total tax | £1,907.25 |

| New Rules: | ||

| Non-Savings Income | Dividend Income | |

| Salary | £9,500 | |

| Dividends | £30,500 | |

| Totals | £9,500 | £30,500 |

| Less: PA | -£9,500 | -£3,070 |

| Taxable | £0 | £27,430 |

| £2,000 @ 0% | £0.00 | |

| £25,430 @ 8.75% | £2,225.13 | |

| Total tax | £2,225.13 |

| Additional tax per new rules: | £317.88 | |

| *assumes same personal allowance and tax bands as 2021/22 | ||

| * no impact on NI as salary within NI-free bands | ||

| Additional tax per new rules: | £317.88 | |

| Additional NI per new rules: | £37.53 | |

| Total Increase | £355.40 | |

Example Impact of 1.25% Increase from 2022/2023: £40k income (£12,570 salary with balance in dividends)

| Current Rules: | ||

| Non-Savings Income | Dividend Income | |

| Salary | £12,570 | |

| Dividends | £27,430 | |

| Totals | £12,570 | £27,430 |

| Less: PA | -£12,570 | £0 |

| Taxable | £0 | £27,430 |

| £2,000 @ 0% | £0.00 | |

| £25,430 @ 7.5% | £1,907.25 | |

| Total tax | £1,907.25 | |

| NI: | Employee | Employer |

| £12,570-£9,568 @ 12% | £360.24 | |

| £12,570-£8,840 @13.8% | £514.74 | |

| Totals | £360.24 | £514.74 |

| New Rules: | ||

| Non-Savings Income | Dividend Income | |

| Salary | £12,570 | |

| Dividends | £27,430 | |

| Totals | £12,570 | £27,430 |

| Less: PA | -£12,570 | £0 |

| Taxable | £0 | £27,430 |

| £2,000 @ 0% | £0.00 | |

| £25,430 @ 8.75% | £2,225.13 | |

| Total tax | £2,225.13 | |

| NI: | Employee | Employer |

| £12,570-£9,568 @ 13.25% | £397.77 | |

| £12,570-£8,840 @15.05% | £561.37 | |

| Totals | £397.77 | £561.37 |

*assumes same personal allowance and tax / NI bands as 2021/22

How can you prepare as a business for the NIC increases?

Being informed and ready for the impact of this increase on your business will be key to future decision-making and business planning. Ensuring best outcome for both employees and the business can be managed through preparation and being aware of the specifics for your company.

Our team can help prepare forecasts and scenarios for your business, based on different approaches for how you deal with the increase in NICs.

Please speak to one of our expert team by clicking here.

All information correct at time of going to print/live and on the best knowledge and understanding of the author at the time. This article is for general information only and does not constitute financial advice or recommendations for individual circumstances. No responsibility is taken for any actions taken on the base of the information within this article.