Don’t Let MTD Catch You Unprepared – Join Our Expert Seminar

9th June 2025

New tax rules for MTD are coming – and they could impact you!

From April 2026, HMRC is introducing mandatory quarterly digital reporting for anyone earning over £50,000 from self-employment and/or property income.

Our records indicate that you meet, or may shortly meet, this threshold. It is critical that you understand your obligations to avoid any financial penalties from HMRC.

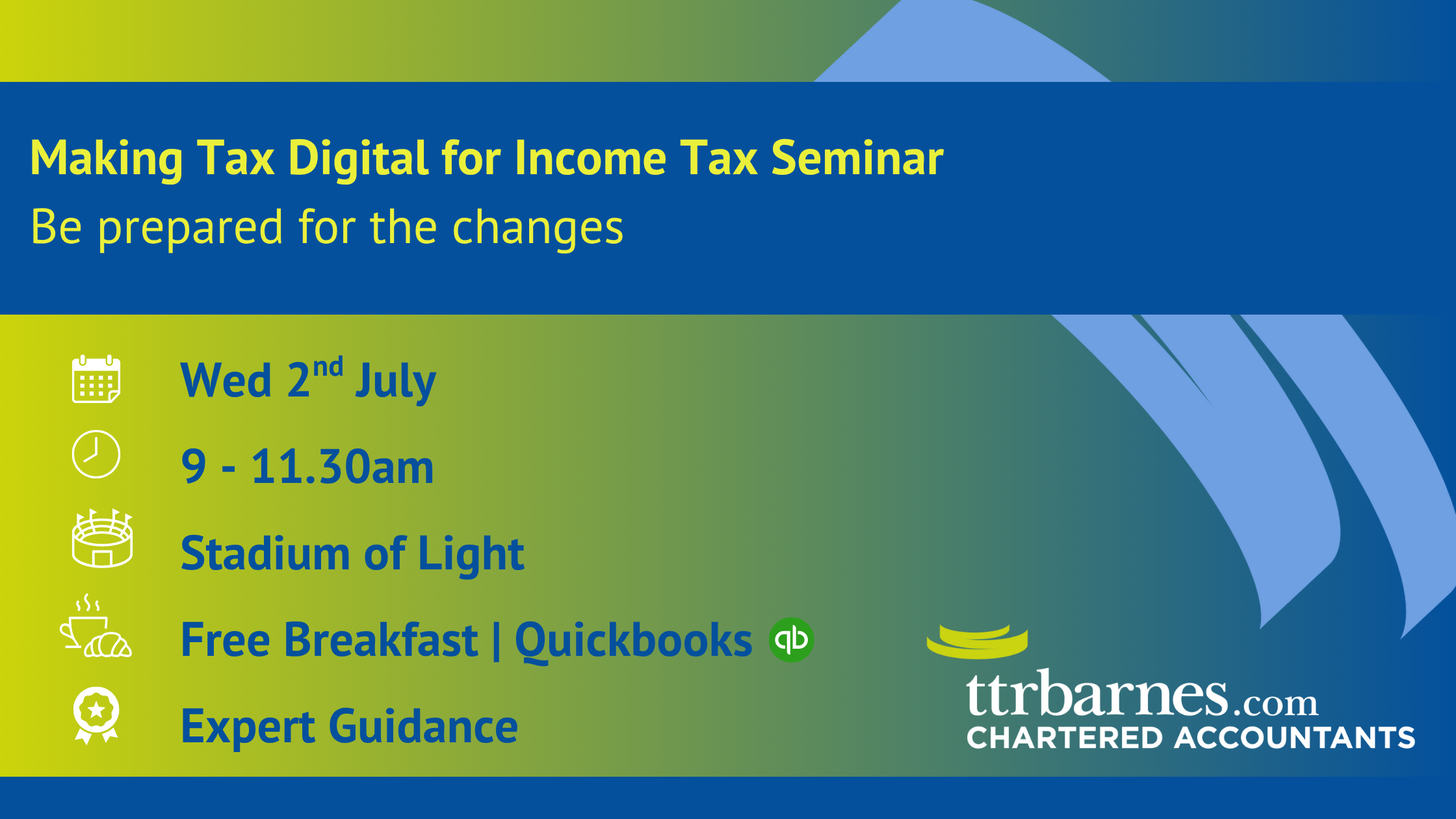

We’re hosting a free MTD for Income Tax seminar that will give you everything you need to prepare:

Event Details:

- Date: Wednesday, 2nd July 2025

- Time: 9:00 AM – 11:30 AM

- Location: Riverview Brasserie, Stadium of Light

What You’ll Learn:

- What MTD for Income Tax rules mean for you

- When they apply, and what you’ll need to do by which date

- How to digitise your income tracking easily and affordably

- Live demo of QuickBooks in action, with their experts on hand

- How we, as your accountants, can manage it all for you

There’ll also be time for questions, and the chance to speak directly with us and QuickBooks specialists about your specific situation.

Places are free, but limited. RSVP now to guarantee your seat.

👉 Reserve Your Seat Now by emailing susan.davison@ttrbarnes.com